USDTRY

The USD/TRY pair stands out with the Turkish Lira showing a relatively strong stance in an environment where emerging market currencies exhibit different performances against the US dollar. The negative trend of Asian indices in external markets is among the factors affecting the overall outlook of the dollar before the US employment data. Limited losses in the dollar index are causing weakness in Asian currencies, while the USD/TRY pair is trading at the 35.31 level. The cautious stance of Fed officials on inflation and China's efforts to stabilize the market are among other significant factors shaping the volatility in global markets.

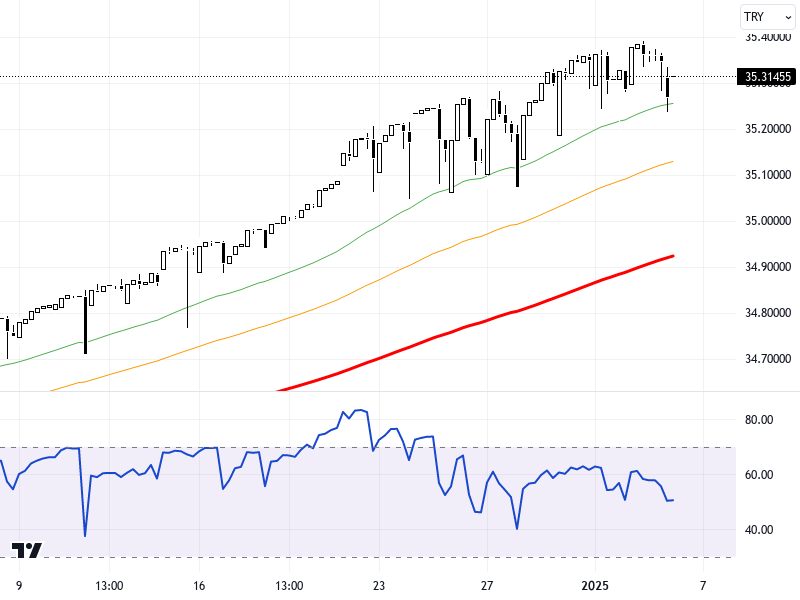

From a technical perspective, the USD/TRY pair maintains a positive outlook by staying above the 35.15 support level. In upward movements, resistance levels at 35.35, 35.40, and 35.45 can be monitored. If it remains above the 35.50 level, which is the upper point of the Envelope indicator, the pair may strengthen its current upward trend. In downward movements, the 35.22 and 35.15 support levels stand out as important areas. The RSI indicator is at neutral levels, displaying a 0.09 percent decrease compared to the previous day. It's indicated that the pair may show a tendency to consolidate in a narrow range.

Support :

Resistance :