USDTRY

The USD/TRY pair is trading in an environment where currencies of emerging countries display varied performances against the US Dollar. The Turkish Lira is painting a weak picture with a depreciation of 0.18%, as the strong course of the dollar index increases the pressure on the TL. Positive economic data from the US and the strong position of the dollar support the rise of the USD/TRY pair. In Turkey, the inflation rates surpassing market expectations are causing the TL to weaken.

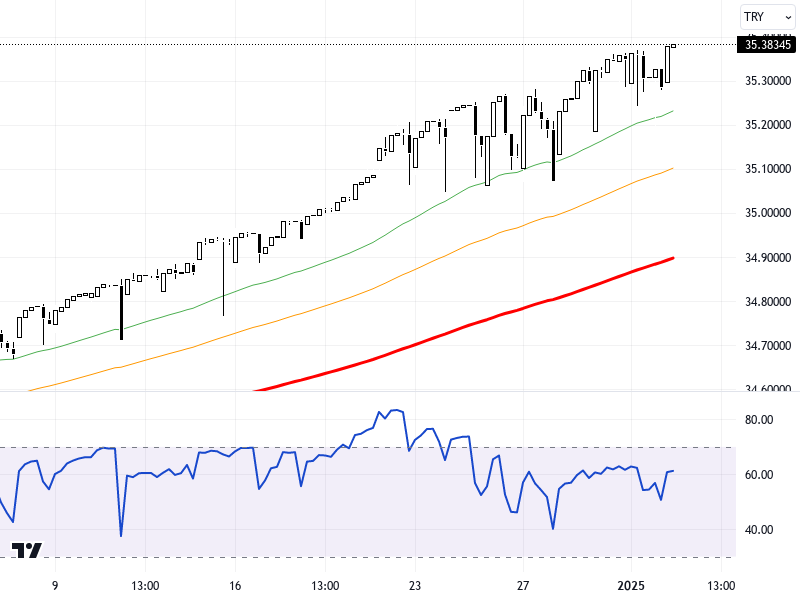

From a technical analysis perspective, the USD/TRY pair is trading near the 35.39 level, and a tendency to consolidate within the 35.17 - 35.52 range can be observed. In upward movements, 35.40, 35.47, and 35.52 resistance levels should be monitored. In downward movements, 35.30, 35.21, and 35.17 support levels are significant. The RSI indicator is at the 61 level, displaying a positive outlook. There is a 0.28% increase in the pair compared to the previous day. If the level of 35.52, which is the upper point of the Envelope indicator, is maintained, the upward trend may strengthen.

Support :

Resistance :