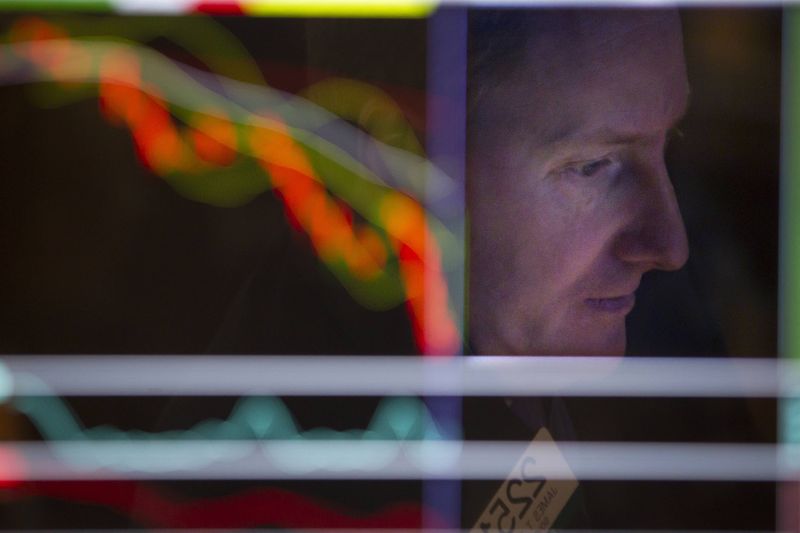

CTAs' Long Positions in Global Equities Worth Approximately $112 Billion: Goldman Sachs

Goldman Sachs predicts that Commodity Trading Advisors (CTAs) currently hold long positions worth approximately $112 billion in global equities, placing them in the 67th percentile. This positioning follows approximately $14 billion in equity sales by CTAs globally last week.

Goldman Sachs' Equity Fundamental Long/Short Performance Forecast declined by 1.51% between December 13 and December 19. This decline was attributed to a negative beta effect of 2.20%, compared to a 3.38% drop in the MSCI World Total Return Index but was partially offset by a positive alpha of 0.69% driven by gains on the short side.

Conversely, Goldman Sachs' Equity Systematic Long/Short Performance Forecast increased by 1.63% during the same period, attributed to a positive alpha of 1.17% from gains on the short side and a beta effect of 0.46%.

Additionally, Goldman Sachs anticipates that the blackout period for share buybacks has begun and is expected to last until January 24, 2025. During such blackout periods, trading desk volumes typically decrease by about 30%.