Relmada Shares Decline Due to Phase 3 Trial Failure

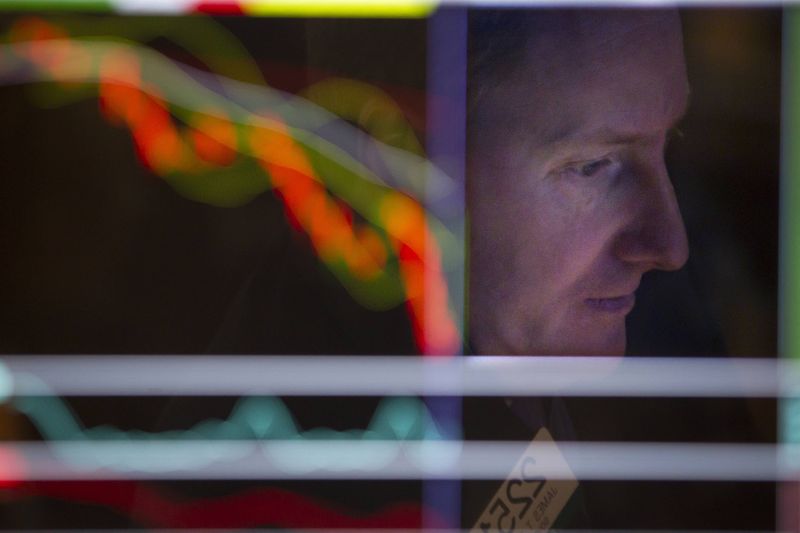

CORAL GABLES, Fla. - Relmada Therapeutics, Inc. (NASDAQ:RLMD) experienced a significant decline in its stock value during pre-market trading on Wednesday, plummeting by 75%. This drop followed the announcement that the company’s independent Data Monitoring Committee (DMC) deemed the Phase 3 Reliance II trial of REL-1017, designed as an adjunctive treatment for major depressive disorder (MDD), ineffective based on an interim analysis. The DMC's assessment indicated a low probability that the trial would achieve statistical significance for its primary efficacy endpoint.

Relmada's CEO Sergio Traversa expressed his disappointment with the interim analysis results. "Based on these results, Relmada will evaluate the complete dataset to determine the next steps for the REL-1017 program," he stated. He also acknowledged the contributions of the research centers and patients involved in the trial.

In light of this setback with REL-1017, Relmada reaffirmed its commitment to the development of REL-P11, a candidate for the treatment of metabolic diseases that is still in Phase 1 of its first-in-human study. The company also reported a strong financial position with approximately $54.1 million in cash and cash equivalents as of September 30, 2024.

It is important to note that the DMC did not identify any new safety concerns regarding REL-1017; however, the ineffectiveness of the Reliance II trial at this stage signifies that the future of the program needs to be reassessed. A comprehensive review of the existing data is expected as Relmada determines its strategic decisions moving forward.

Commenting on the news, Mizuho analyst Uy Ear stated: "Given the protocol modifications and rigorous trial oversight, we had hoped the DMC would suggest no increase or a modest increase in sample size post-interim analysis. The finding of ineffectiveness is truly disappointing and likely signifies the end for REL-1017 in MDD. A sharp decline for RLMD is probable."