Stocks Exposed to Brazil Decline Amid Concerns Over Tax Reform

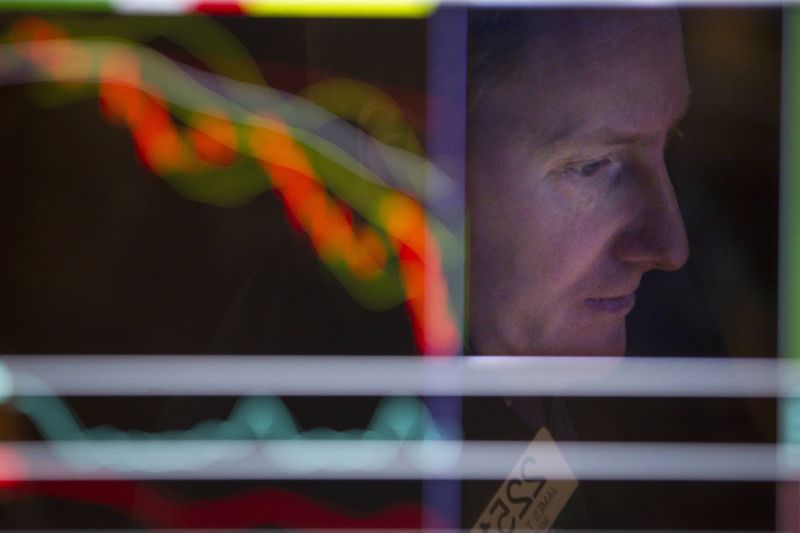

On Friday, following the announcement of an income tax reform proposal in Brazil, stocks traded on U.S. exchanges with exposure to Brazil experienced significant declines. Petrobras (NYSE:PBR) fell by 4%, while Nu Holdings (NYSE:NU) declined by 4.7% and Vale S.A. (NYSE:VALE) decreased by 2.6%. Additionally, Banco Bradesco (NYSE:BBD) dropped by 7%, Itau Unibanco Banco Multiplo S.a. (NYSE:ITUB) fell by 6%, and StoneCo (NASDAQ:STNE) saw a 5% drop. The iShares MSCI Brazil ETF (NYSE:EWZ), which tracks Brazilian stocks, lost 5% in value.

The Brazilian real weakened significantly, falling by 1.6%, failing to benefit from the rally experienced by other emerging market currencies. The performance of the real this week, with a decline of approximately 5%, was recorded as the worst among emerging economies. The ETF reflecting Brazilian stocks also dropped by 4.6% in pre-market trading in New York, preparing to extend its 3.8% losses from the previous Wednesday's sessions.

Investor confidence in Brazilian assets is diminishing due to rising debt levels in the country and increasing spending commitments from President Luiz Inacio Lula da Silva to fulfill election promises. The budget deficit figures for October rose to 74.68 billion reais, exceeding the previous month's deficit of 53.8 billion reais and economist forecasts of 50.1 billion reais.

Finance Minister Fernando Haddad's plan to reduce public spending by 70 billion reais by 2026 has been viewed with skepticism, as it is deemed insufficient to curb the budget deficit. President Lula's addition of tax exemptions for the poor further fueled doubts about the government's commitment to fiscal discipline.

This financial uncertainty has affected inflation expectations, prompting Brazil's central bank to consider interest rate hikes during a period when the Federal Reserve is signaling policy easing. Market forecasts now predict a 88 basis point increase in the benchmark Selic rate in December and a 91 basis point increase in January. Incoming central bank president Gabriel Galipolo expressed concerns about unmanageable inflation expectations, suggesting that Brazil may need to maintain higher interest rates for an extended period.

Emerging market assets have generally declined since the U.S. elections, amid expectations of rising global interest rates and a strengthening dollar. However, the decline in the Brazilian market has been particularly sharp; the real's 20% drop this year has made it the worst-performing currency among major emerging market currencies. The Ibovespa stock index has also suffered, losing over 7% in value this year, underperforming compared to other emerging market stocks and global benchmarks.